How to Find the Simple Deposit Multiplier

Thus to sum up in the end the money multiplier is one of the closely related ratios of commercial bank money under a fractional-reserve banking system in monetary economics or macroeconomics. The simple deposit multiplier assumes that banks hold no excess reserves and that the public holds no currency.

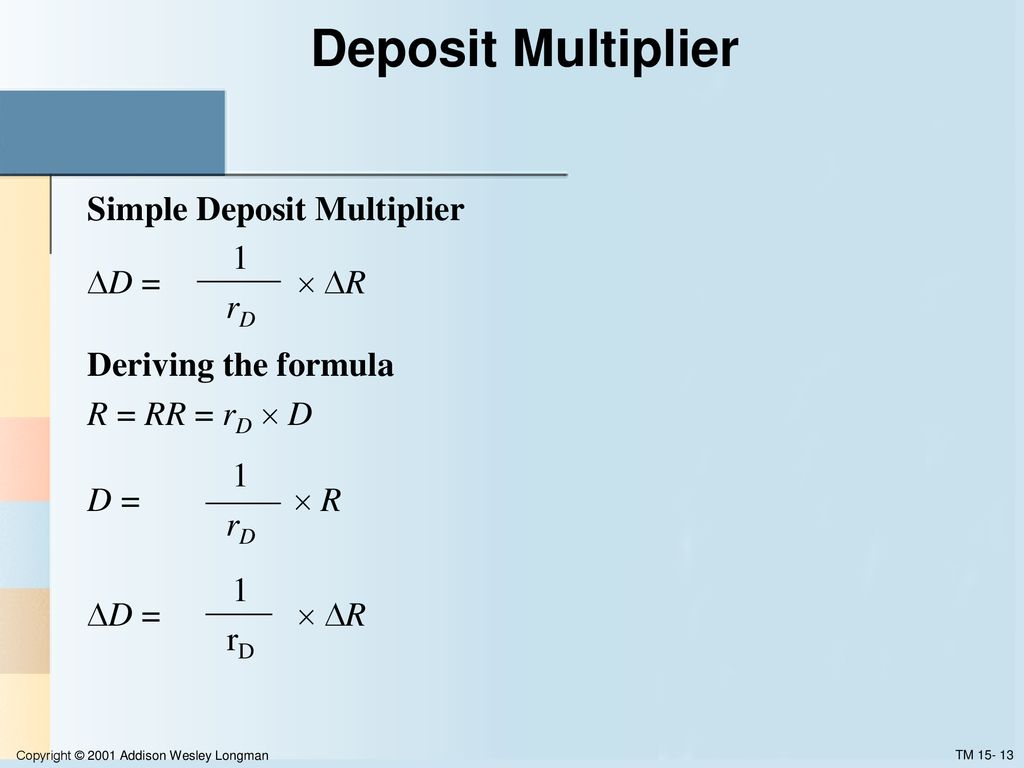

Multiple Deposit Creation And The Money Supply Process Ppt Download

Money Multiplier Formula.

/dotdash_final_Deposit_Multiplier_Dec_2020-01-12355ee057a74ef1887bb1066444b606.jpg)

. -- Enter Reserve Ratio Percent-- Enter Initial Deposit. 465 1823 Views. The first student says if the reserve ratio is kept low the more money supplies the lower the inflation in the economy.

Firstly ascertain the value of money deposited at the bank which can be in the form of a recurring account savings account current account fixed deposit etc. R change in reserves. The formula for Multiplier can be calculated by using the following steps.

The simple deposit multiplier is D 1rr R where D change in deposits. It allows banks to meet the withdrawal demands of their clients and to limit the potential risks associated with. The percentage of checkable.

This calculator determines the money multiplier. The ratio of the amount of new reserves to the amount of deposits created by banks. Next ascertain the value of money lent by the bank in the form of loans.

10 Votes The simple deposit multiplier is D 1rr R where D change in deposits. Business and finance interest rates. So if your bank had 100 million you would subtract 16 million for a total of 84 million.

This amount would be the total every day susceptible to reserve requirements. Simple Deposit Multiplier 11 - RR. Two students were arguing with each other on the topic of a money multiplier.

At the same time the second student stated that the higher the ratio the less the money supply which would reduce inflation. The simple deposit multiplier formula is given below. Enter Money Multiplier Inputs.

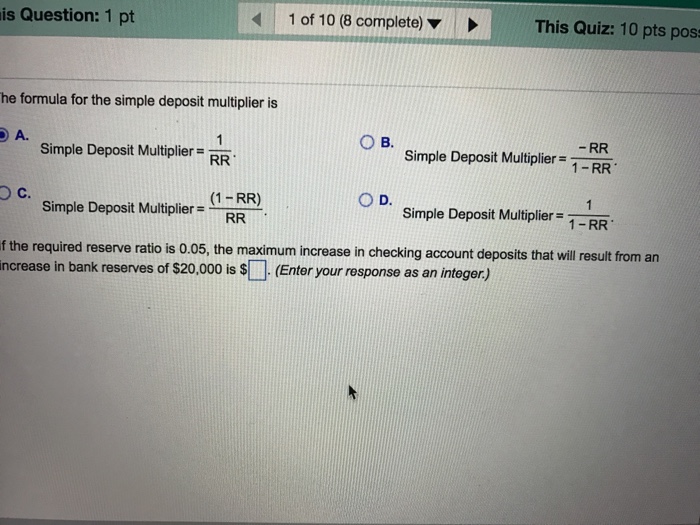

The formula for the simple deposit multiplier is A. Firstly determine the number of deposits received by the bank in the form of the current account savings account recurring account fixed deposit etc. To calculate the formula under current regulations take the full amount of money in your bank and eliminate the first 16 million.

If the required reserve ratio is 015 the maximum increase in checking account deposits that will result. It is simply related. The ratio of the amount of deposits created by banks to the amount of already existing reserves.

Also known as the simple deposit multiplier or the deposit expansion multiplier the deposit multiplier is essentially the amount of money kept in the reserve account of a bank as a requirement to allow for continued functionality. The simple deposit multiplier is O A. The ratio of the amount of deposits created by banks to the amount of new reserv OB.

The formula for money multiplier can be determined by using the following steps. Simple Deposit Multiplier -RR1 - RR. Simple Deposit Multiplier 1RR.

Simple Deposit Multipliers 1 - RRRR. Bank 4 lends 90 percent of that Bank 5 lends 90 percent of that and so on until a 100 initial increase in reserves has led to a 1000 increase in deposits and loans. Money Multiplier CalculatorRelending process.

Deposit Multiplier frac1textRequired Reserve Ratio Conclusion. Ratio what the simple deposit multiplier FAQif the required reserve ratio what the simple deposit multiplier adminSend emailDecember 23 2021 minutes read. Next determine the number of loans extended to the borrowers.

Rr required reserve ratio.

Creating Money And The Simple Deposit Multiplier Youtube

Solved Is Question 1 Pt 1 Of 10 8 Complete This Quiz 10 Chegg Com

:max_bytes(150000):strip_icc()/dotdash_final_Deposit_Multiplier_Dec_2020-01-12355ee057a74ef1887bb1066444b606.jpg)

Comments

Post a Comment